Business Lines of Credit

A business line of credit (BLOC) functions like a credit card for companies: a lender sets a maximum limit, the borrower draws funds when needed, repays principal and interest, and can redraw up to the limit during the draw period; interest is charged only on outstanding balances rather than the full limit, and many lines are revolving so they renew or can be renewed after a set term, providing ongoing access to capital.

Real Estate Financing

Commercial real estate financing provides tailored loan products to buy, develop, or refinance income‑producing property, with options that vary by term, collateral, and underwriting—choose the product that matches your property type, cash‑flow profile, and exit plan.

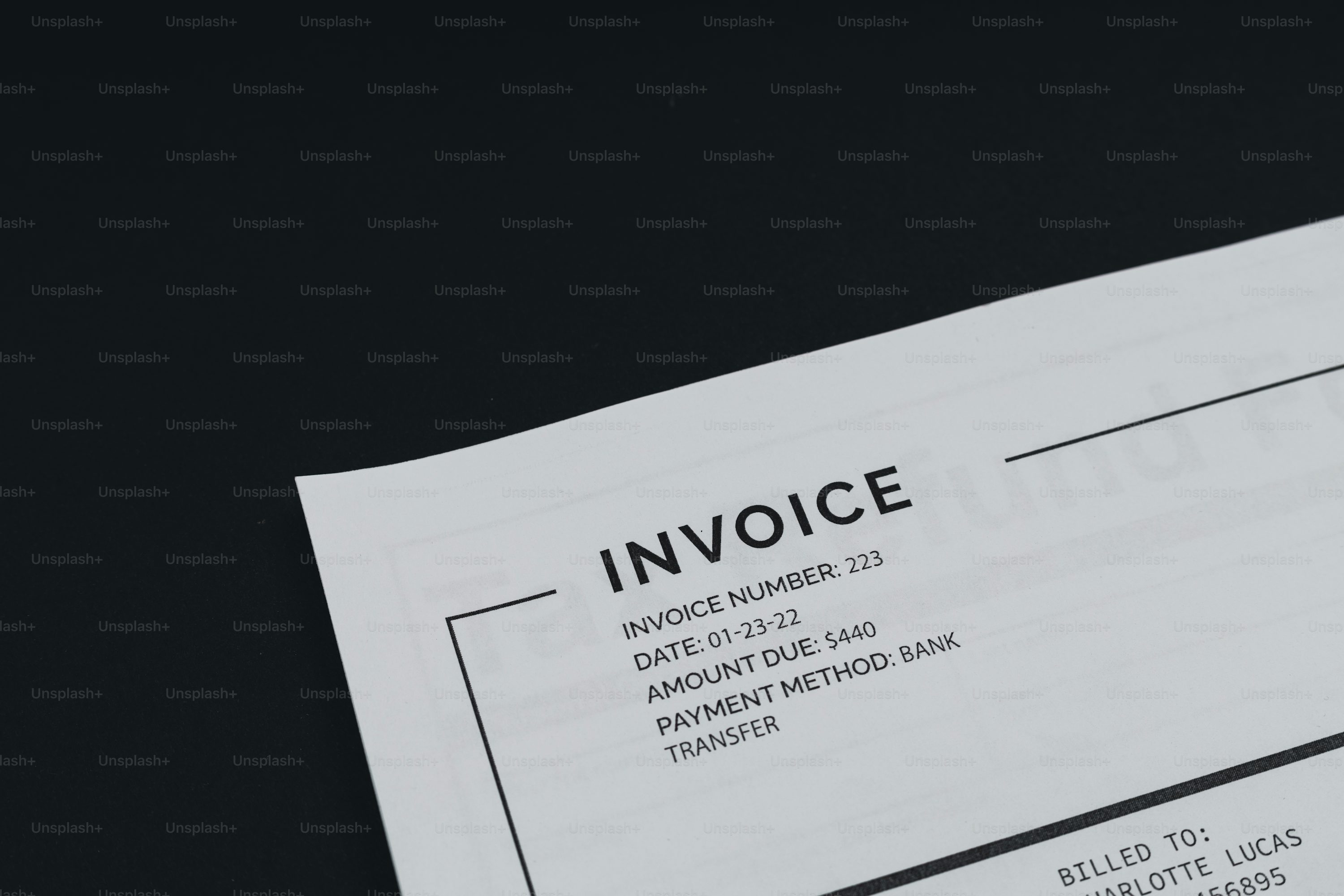

Invoice Factoring

Invoice factoring offers businesses the highest degree of flexibility when it comes to getting working capital. Invoice factoring gives you the freedom to sell open invoices and receive cash for a set discount fee. Invoice factoring is a financial service used to boost a company’s cash flow. Invoice factoring is not a loan. A company sells its unpaid invoices to the factoring company at a discount. The factoring company provides immediate capital for those invoices. The factoring company now owns the invoices and will collect according to the payment terms of the unpaid invoices from the customer who is being invoiced, typically 30-60 days.

Working Capital Loans

A working capital loan is a short‑term debt product that helps businesses bridge cash‑flow gaps and maintain operations during periods of low revenue or when timing mismatches occur between receivables and payables. These loans are explicitly intended for operational expenses rather than long‑term investments or capital projects.

Credit Card Processing

We offer next-generation technology for every business type, including: contactless countertop terminals, tablets, mobile solutions, high-end POS terminals, ecommerce solutions, and more

Highly competitive pricing including the lowest possible rates. 24/7, live customer care and technical support. A wholly owned, in-house processor for completely seamless end-to-end transactions. Risk-free service agreements with no startup costs and no hidden or cancellation fees. Robust reporting tools and simplified customer, employee, inventory, and chargeback management. Unrivaled data security including the very latest in encryption and tokenization.

Business Entity Setup

LLC

Going solo or teaming up? Make sure you're not personally on the hook for business liabilities with an LLC.

Corporation

Plan to issue shares, go public, or go global? Go further as a corporation.

Nonprofit

Create an organization to give back and be eligible for tax breaks.